Wind turbines blow down property value, says expert

Sep 24, 2012

Editor’s note: In an article unsubtly titled “Wind Industry Big Lies,” British journalist James Delingpole zeroes in on Big Wind’s biggest lie of all:

And there’s no direct evidence that they affect house prices, in fact the Royal Institute of Chartered Surveyors says they don’t.”

—RenewableUK (aka British Wind Energy Association)

“This,” indignantly responds Delingpole, going for the jugular, “is a quote—a genuine quote: not one devised by his enemies to satirise the outrageous absurdity of the wind industry’s specious claims—from Maf Smith, Deputy Chief of the wind industry propaganda arm RenewableUK [formerly called the British Wind Energy Association]. I suppose how far it qualifies as a lie depends on how you construe that weasel phrase ‘direct evidence.’ Evidence of one kind or another there certainly is aplenty.” There is indeed, and Delingpole goes on to provide it. Click here to read Delingpole’s article.

In the article, below, veteran Chicago property appraiser, Michael McCann, adds his own rebuttal to RenewableUK’s deceit.

“Direct Evidence of Value Impact: An Appraiser’s Perspective on Living with Wind Turbines”

—Michael S. McCann, CRA, McCann Appraisal, LLC (Chicago, Illinois, USA)

I can understand why some people have no clue as to what constitutes “direct evidence of value loss” when they have zero training or education as a professional appraiser. Further, when self-interest is placed above objective analysis by anyone, wildly different opinions are the result.

However, different does not mean equal. Being duly licensed, and with over 30 years experience in professionally evaluating the impacts of one land use on the value of another, please permit me to clarify.

There is a hierarchy of evidentiary value, or how reliable certain information is construed, vis-à-vis other forms of potential evidence.

Case Study Data: The most reliable method for determining property value

The most reliable evidence is represented by Case Studies, or individual examples of value loss, directly linked to the cause of value loss. This can be true for a contaminated property, a loss of parking from a shopping center, or indeed from a wind energy project of one or numerous turbines.

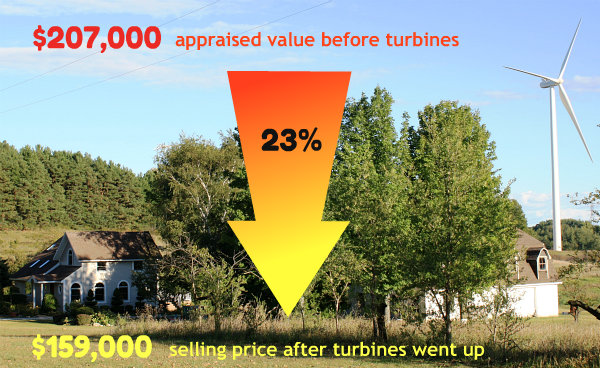

A good example of a Case Study is represented by a recent appraisal assignment in Michigan. I appraised this home (see above) prior to the approval or construction of the Consumers Energy Lake Winds project in Mason County, Michigan. All pre-turbine comparable sales considered, this property was worth $190,000. Nice home on a small acreage lot, remodeled and updated, great view of apple orchards and a rural countryside.

I appraised this property in June 2011, and the market increased about 9% since then, indicating it should have increased in value to about $207,000. With a typical Sale:List price ratio of 95%, under pre-project conditions, this adjusted value should have resulted in a recommended list price of $217,900, to allow for the negotiation to bring the selling price to the $207,000, June 2012 “market value.”

However, since then the wind turbine project was constructed and industrial-scale turbines have been built within about 1/4 mile of this residence (and many others). This family decided to move away from the turbines (which, incidentally, establishes the direct link) and local realtors told them that being located in the turbine project, they would not list the property based upon the appraised value, and would not list it unless it was discounted to a $169,000 asking price.

Thus, the realtor community acknowleged the loss of marketability, and enforced a beginning discount that was contrary to the pre-turbine project market value, much less the increase since then. With the nearest turbine quite obvious and present, the final sale price was $159,000, or 23% lower than market value (as adjusted for market appreciation during the intervening year).

In this Case Study example, the nearest turbine had been only “tested,” and there was no direct experience for the seller in their own home with any noise, audible or LFN, or flicker, although clearly within range of both noise and visual impacts. One of the owners did spend one night in a residence similarly situated near a turbine in the same turbine project that was running that night, and reportedly was disturbed to the point of being convinced he would not be able to endure living under such conditions.

This case study illustrates a 23% value reduction, clearly, and with no innappropriate considerations, from an appraisal perspective.

Absurdly, the wind energy industry has attempted, with some success, to cast this direct type of evidence as being “merely anecdotal,” and in their (non-expert) judgment, unreliable.

On balance, the Appraisal Institute is a far more reliable and authoritative source on valuation matters, methodology and techniques. It is, as well, the leading education provider for appraisers in the USA, and is the oldest appraisal association. Their published text on valuation of detrimental conditions clearly states that “Case Studies” are the most reliable data upon which to base a professional valuation conclusion in situations of detrimental conditions—like this one.

In addition, courts of law will typically consider a very recent sale of a property to be the “best” evidence of its value—not merely “anecdotal.” The Uniform Standards of Professional Appraisal Practice (USPAP), which is a regulation applicable to the entire community of licensed appraisers, has a specific regulation (SR 1-5) which mandates an appraiser “must consider and analyze any sale of a subject property within the prior 3-year period.”

With regard to Case Study data, what the wind industry calls anecdotal or unreliable is exactly the type of information that the appraisal profession and the courts typically rely upon as being the best evidence.

Bottom line: Case Study data is factual and empirical, and is therefore the most reliable.

.

.

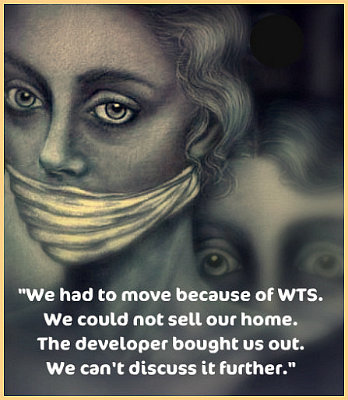

Editor’s note: WTS stands for “Wind Turbine Syndrome”

As a side note, I am aware that many homeowners bought out by wind developers or compensated for nuisance or value loss, have done so with required confidentiality agreements—in other words, “gag orders.” This, of course, makes Case Study data hard to come by.

Paired Sales: The second most reliable method for determining property value

With that said, the second most reliable basis for demonstrating a “detrimental conditions” valuation opinion, when one does not have enough factual background on Case Studies, is the use of “paired sales.” That is, one sale near turbines and one far away, in order to isolate the impact of the turbines on value. Of course, there still will be other disimilar features—say, a fireplace, for which the appraiser can make a reasoned judgment as to the contributory value of a fireplace to a home’s sale price, and make an adjustment for this or any other relevant differences. Since it requires a certain amount of judgment, use of Paired Sales is not immune from critique. One person may assume that the cost to install a fireplace (say, $10,000) is the appropriate basis for adjustment, and another may be able to demonstrate that the local “market” only pays 50% of cost, or $5,000 for a good quality fireplace. These types of assumptions can skew the results of analysis. (More on this, below.)

Regression Analysis: The least reliable method for determining property value. (This is the method used by the wind industry.)

Regression Analysis is the technique that was used by the now well-circulated Hoen/Lawrence Berkeley National Laboratory report. The Appraisal Institute recognizes this technique as the third and least reliable method, which should only be used in the absence of data, such as the type of Case Study data that is most reliable and preferable, or absent the data to perform a Paired Sales analysis.

The problems with Regression Analysis are numerous. As in the “fireplace” example, above, the “researcher” has considerable latitude in setting the value of many of the variables, ostensibly to solve “ceteris paribus” (“everything else being equal”) for the dependent variable, or value impact from turbines. Poor choices by a researcher can greatly doom the analysis results, rendering it a case of “garbage in, garbage out.”

Statistical significance can be manipulated, as well, by “pooling” data from disimilar locations. (Google the phrase, “Final nail in Hoen’s coffin.”) Preceding an excellent analysis of the Sunak regression study from Germany in 2012, with isolated markets studied separately, Dr. Alec Salt wrote a succinct analysis of why wind developers use a 10 km study radius! Basically, it allows statistical significance of unhelpful data to be weakened.

Beyond the Regression Analysis technique itself, one must also consider the objectivity of the analyst. The Lawrence Berkeley National Laboratory (LBNL) report (2009) authored mainly by Ben Hoen is highly suspect in this regard. Hoen was under contract (along with the Univ. of Calif. at Berkeley) to prepare the report for the US Dept. of Energy (USDOE), both of which (UC Berkeley and US DOE) are vigorouly and publicly “pro-wind turbine.” This creates a potential for “advocacy,” rather than an independent, objective study—hardly the objective standards required of professional appraisers.

Moreover, not being a licensed appraiser, Mr. Hoen was not bound by any enforceable code of ethics or standards of practice. Although his report “looked” (to the untrained eye) to be compelling, in fact it failed to follow the property appraisal industry’s “best practices” standards. Al Wilson, an appraiser eminently qualified in both Regression Analysis for mass appraisal and in assessing the impact on value from contamination, points out that Hoen’s Regression model fails to conform to any of the accepted and tested (verified) Regression models used by assessor’s for valuing properties for either ad valorem assessment or “mass appraisal” projects. It was idiosyncratic—custom made—for this project. Leading Wilson to conclude that the LBNL report is unreliable for any public policy purposes.

As an invited “peer reviewer” of the 2009 LBNL report, I think it is fair of me to to point out that the authors elected to omit significantly important data, i.e., about 3 dozen sales within 3 miles of turbines that “deviated too far from the mean,” and a few developer buyouts, with only 2 re-sold from the developer in private transactions at 36% and 80% discounts from the prices just paid. Thus, the sales which were most likely to affect any objective determination of value impact from turbines—that is, those “nearby”—were omitted. (See LBNL report, Dec. 2009, pp. 13-14, footnote 27.)

The Regression technique does not always yield unreliable or biased results. The Clarkson University study (2011) and the recent report out of Germany by Sunak (2012) both used Regression methodology and, without “pooling” the data, statistically significant findings were developed as high as 40% value loss (1/10 mile from turbines: Clarkson study), 20% value loss (3 miles from turbines: Clarkson), and 25% value loss (lot values within 2 km: Sunak).

Both the Clarkson and Sunak studies focused on nearby property values, which Hoen says they “know little about.” I submit that the nearby property values are exactly the issue, when considering zoning, siting or otherwise permitting of wind farms.

Finally, Hoen did not write that turbines cause “no impact on value.” He in fact acknowleged that there are cases “nearby” where values are likely impacted. However, he then fell back to the pooled data to claim that such impacts are neither uniform, widespread or statistically significant. His claim is reasoning is absurd; one would not expect impacts to be “widespread” in a 10-mile radius, nor “uniform” from one value loss example to another.

.

.

Ben Hoen

In conclusion, it’s evident that wind developers are not relying on studies that utilize accepted appraisal methodolgy or techniques, since there is indeed data available to demonstrate what the impacts are (or are not) using Case Studies and Paired Sales—or even by using more reliable, independent and objective Regression studies. It’s worth pointing out that wind developers often misquote Hoen, and claim the report states “no value impact from turbines.”

Hoen and I agree on one thing: Property Value Guarantees (PVG’s) should be used with any wind project. This would cause all wind developers to be more careful in the siting location of any turbines, and also provide the basis for compensating or buying out owners who cannot live near turbines due to health or nuisance impacts, or who have had their home equity diminished by shoehorning turbines into populated areas, with no regard for compatibility with the neighborhood.

As a professional appraiser, I am not permitted to be biased for or against any client or issue. But I can advocate my professional opinions. Based on my review of wind turbine development and value impact trends, I can state confidently that there are indeed impacts on value near industrial-scale turbines. The data tends to support a range of 25% to 40% devaluation, although with so many homes abandoned after the development and operation of nearby turbines, the loss of equity is sometimes total.

When wind energy developers propose setbacks in terms of feet and meters, instead of miles and kilometers, they are essentially insuring that there will be negative impacts on property values, together with safety and welfare impacts. I leave the health and noise impact issue for physicians and credible acoustical engineers to address, except to point out the obvious: these impacts are what cause many people to move away from wind projects. Value loss is merely a means of partially quantifying the health effects of wind turbines.

.

Editor’s note: Mr. McCann can be reached at mikesmccann@comcast.net

Comment by Cary Shineldecker on 09/24/2012 at 9:02 pm

I hope we end up as another case study for Mr. McCann. With the nearest 500′ turbine within 1139′ of our property line and just a bit more to our bedroom windows, and another 7 within 2640′, 13 within 5280′, and 23 within 1.5 miles, our house will be a tough sell, if not impossible.

We have had the house for sale for over 18 months with not so much as an “insult offer.” I even offered it as an Energy Fair Special on the weekend of the Michigan Renewable Energy Fair held in our town. I even stated, no reasonable offers would be refused. What are we to do when we are thrown under the bus by our own government and neighbors?

This is a great article. Straight, honest, and on target. Our county used Hoen’s work to prove there would be NO value loss! Unbelievable indeed!

Comment by Raymond S. Hartman, PhD on 09/25/2012 at 12:58 pm

I am a resident of Shelburne Falls, MA, a town in the Berkshires which is facing an attempted influx of industrial wind turbines. The Governor, Deval Patrick, is a committed (and unreflective) proponent of wind energy and has commissioned studies that, “Surprise!” found no adverse health or property value effects. However, the studies have relied upon flawed and mischaracterized interpretations of regression studies such as that reported by Ben Hoen et al. These studies are Junk Science. They misuse and mischaracterize the results of regression analysis of cross-sectional data. Mr. McCann is correct in his criticisms and his conclusions.

I have a BA from Princeton University and a Masters and PhD from MIT. All of my degrees are in mathematical economics. I have been a member (Associate Professor) of the faculties of MIT, Boston University and University of California, Berkeley. I have published more than 100 peer-reviewed articles and contract research using statistical and mathematical models, methods and data. I am currently President and Director of Greylock McKinnon Associates, an economic consulting firm specializing in analysis in support of litigation.

Indeed, I regularly have testified as an expert witness on behalf of the Massachusetts Attorney General’s office in a variety of matters, including the 1995-1996 tobacco litigation (the result of which the Commonwealth received billions of dollars in settlement from “Big Tobacco”); litigation against large drug companies for defrauding the Massachusetts Medicaid program (2008-2011); the restructuring of the electric power industry (1990s); and a variety of utility rate cases (2000s).

Over the past 40 years, I have reviewed and responded to hundreds of “expert reports” like the “Wind Turbine Health Impact Study” put forward by the state at the behest of Gov. Patrick, and the study conducted by Ben Hoen.

It is against this professional background that I can categorically declare the analysis conducted by Hoen et al. to be Junk Science. The Hoen report is similar to the analysis conducted by the Tobacco Research Institute (an “independent research group”) funded by Big Tobacco, which found that smoking had no adverse health effects.

In the same vein, the “wind turbine health” analysis put forward by Governor Patrick is Junk Science.

Comment by Mauri Johansson, MD (Denmark) on 09/25/2012 at 6:11 pm

We have similar experiences in Denmark. The drop of newly, professionally-assessed houses (8 in all) dropped 10 to 30% in value. Six of them dropped 30%, one 20%, and one 10%.

It’s a devastating blow, besides the problems people have for other reasons. We have a very low turnover rate in the Danish housing market in recent years, so in reality these houses are unsaleable.

Mauri Johansson, MD

Denmark